Master QuickBooks – Easy Small Business Tips

Master QuickBooks – Easy Small Business Tips

Introduction

In the rapidly changing business era, efficient handling of money is essential to succeed. QuickBooks, created by Intuit, has become one of the most popular accounting software packages for small to medium enterprises. With its user-friendly interface and powerful features, accounting software offers simplicity in conducting activities like invoicing, tracking expenses, payroll processing, and financial reporting.

1. Getting Started with accounting software

Choosing the Right Version of accounting software

QuickBooks is available in multiple versions to serve various business needs:

- financial tool Online: Cloud-based and available anywhere, ideal for businesses that need flexibility.

- accounting software Desktop: A powerful desktop application that is suitable for businesses that need sophisticated features and aren’t opposed to being bound to a location.

- business bookkeeping platform Self-Employed: Ideal for freelancers and independent professionals to easily track income, expenses, and tax deductions.

- business bookkeeping platform Payroll: A wages, tax, and benefits tracking add-on for employees.

Setting Up Your Account

- Sign Up or Log In: Visit the business bookkeeping platform, select your option of choice, and sign up.

- Enter Business Information: Input the business name, address, and tax identification number.

- Select Your Industry: accounting software adjusts its functionality based on your industry to give you relevant suggestions.

- Choose Your Fiscal Year: Choose your fiscal year to match your accounting periods.

2. Navigating the Dashboard

The QuickBooks dashboard is designed for ease of use:

- Overview: Take a peek at your money, such as income, costs, and profit and loss.

- Navigation Menu: Access features such as invoicing, expenses, and reports.

- Customization: Make the dashboard mirror the most important information for your organization.

3. Financial Management

Linking Bank Accounts

Connect your business credit and bank accounts to accounting software so that it will import transactions automatically, reducing manual entry and errors.

Tracking Income and Expenses

- Categorization: Classify transactions into accurate categories for timely financial reporting.

- Receipt Capture: Capture receipts using the mobile app and link them to related expenses.

- Recurring Transactions: Set up repeating income or expense to enter repetitive regular entries.

4. Invoicing and Payment

Issuing and Dispatching Bills

- Personalize Your Experience : Brand your account with your logo, custom colors, and tailored client messages.

- Automation: Create repeat invoices for frequent customers.

- Payment Reminders: Set up automatic reminders for late payments.

Accepting Payments

accounting software accommodates various payment gateways via which customers can pay directly from the invoice using credit cards, bank transfers, or other available means.

5. Payroll Management

Accounting Software Payroll simplifies paying employees:

- Employee Profiles: Maintain detailed information, including salary, tax, and benefits.

- Automatic Computations: Compute wages, taxes, and deductions accurately.

- Seamless Payroll – Send employee wages straight to their bank accounts with direct deposit.

- Tax Filing: Automatically file and complete required tax returns.

6. Inventory Tracking

For companies that handle tangible products, inventory control is essential:

- Product Listings: Add products with columns like SKU, price, and quantity.

- Inventory Levels: Monitor inventory levels constantly to prevent stockouts or overstock.

- Reorder Alerts: Set thresholds so you’re alerted when supplies are low.

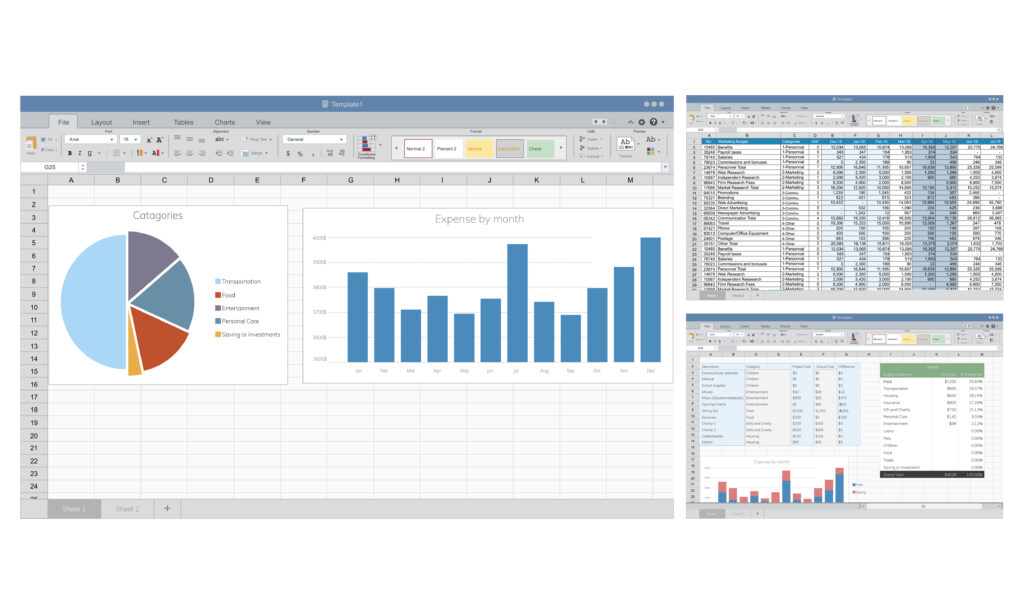

7. Reporting and Analytics

QuickBooks also has a sequence of reports to monitor your business performance:

- Profit and Loss Statement: Get to know your net income over a period.

- Clear Financial Overview – Monitor your business health with a simple breakdown of assets, liabilities, and equity.

- Cash Flow Statement: Track inflow and outflow of cash.

- Custom Reports: Generate reports that suit your specific needs best.

8. Integrations and Add-ons

Enhance QuickBooks functionality by integrating with third-party apps:

- CRM Systems: Match customer data to enhance relationship management.

- E-commerce Platforms: Integrate with online shops to automate sales and stock.

- Time Tracking Tools: Monitor the employees’ working hours for accurate payroll processing.

9. Mobile App Features

Stay Connected on the Go – Manage finances anytime with the QuickBooks mobile app.

- Invoice Creation: Generate invoices directly from your phone.

- Expense Tracking: Scan receipts and organize expenses in real-time.

- Real-time Data: Access up-to-date financial information anytime, anywhere.

10. Data Protection and Security

QuickBooks keeps your financial information safe first:

- Encryption: Data is encrypted to avoid unauthorized access.

- Routine Backups: Routine backups ensure data is not lost.

- User Permissions: Control levels of access for different users within your company.

11. Troubleshooting Common Problems

While QuickBooks is user-friendly, some people still encounter occasional challenges when navigating its features.

Here’s what to do in case of some common problems:

Login Problems

- Incorrect Credentials: Make sure you are typing in the proper username and password. Forgot, click on the “Forgot Password” link to reset.

- Browser Problems: Clear your browser cache or attempt to run QuickBooks in another browser.

Data Sync Errors

- Bank Feeds Not Updating: Check your internet and whether your bank’s website is not in maintenance mode.

- Transaction Duplication: Reconcile your accounts regularly to spot and consolidate duplicate transactions.

Performance Lag

- Software Updates: Ensure you are running the latest version of QuickBooks.

- System Requirements: Make sure your computer meets the system requirements required to run effectively.

Pursuing Help

If problems continue, QuickBooks has several support avenues:

- Help Center: Get access to thousands of articles and tutorials.

- Community Forums: Discuss with other users and experts for a solution.

- Customer Support: Get assistance from QuickBooks support by chat or phone for personalized help.

12. Advanced Tips and Tricks

Maximize your QuickBooks experience with these enhanced features:

Use Keyboard Shortcuts

Boost your productivity by mastering keyboard shortcuts:

- Ctrl + I: Create an invoice

- Ctrl + W: Write a check

- Ctrl + F: Find a transaction

- Ctrl + M: Recall a transaction

- Ctrl + Q for instant transaction reports.

Automate Repetitive Transactions

For recurring expenses or revenues, save time and stay consistent by using recurring transactions.

Personalize Reports

Customize reports to your requirements by choosing suitable data columns, using filters, and saving custom templates to reuse repeatedly.

Integrate with Third-Party Apps

Enhance QuickBooks’ capabilities by connecting with apps such as:

- Expensify: Simplify expense reporting

- Trello: Manage projects with accounting

- HubSpot: Seamlessly integrate CRM with QuickBooks to streamline workflows

13. Case Studies

Case Study 1: See how a retail business streamlined operations using QuickBooks automation.

A small retail business integrated QuickBooks into their website, allowing real-time inventory tracking and automatic sales recording. This integration reduced human error in data entry and optimized inventory management efficiency.

Case Study 2: Enhancing Financial Reporting for a Service Provider

A business-to-business firm utilized accounting software ability to generate custom reports to build detailed profit and loss statements by service lines. The level of detail enabled the firm to identify high-performing services and better allocate resources.

14. Conclusion

QuickBooks is an ideal companion for small businesses, offering functionality that simplifies accounting, makes financial data more visible, and drives decision-making. By leveraging its functionality—from basic invoicing to more advanced integrations—you can optimize your financial efficiencies and focus on growing your business.

Frequently Asked Questions (FAQs)

Frequently Asked Questions Regarding QuickBooks What is QuickBooks used for?

accounting software is a computer accounting program for small to medium-sized enterprises. It assists in managing income, expenses, payroll, inventory, and taxes and offers features for creating invoices, monitoring finances, and reporting.

Should QuickBooks be used by freelancers and the self-employed?

Yes, financial tool also has a specialized version for freelancers, gig economy workers, and sole proprietors, called accounting software Self-Employed. It’s intended to simplify expense tracking, mileage tracking, and estimating taxes.

Is accounting software usable even without accounting background?

Yes! financial tool is simple to use, easy to navigate, and has help built in. Some general knowledge of finance is beneficial, but you don’t have to be an accountant to use it to its full capabilities.

QuickBooks Online vs. QuickBooks Desktop: Which Works for You?

financial tool Online is browser-based access using a browser, ideal for people who enjoy flexibility and access from multiple different devices. financial tool Desktop is locally installed software with richer functionality, ideal for businesses that don’t need to access remotely.

Is my information secure in accounting software?

Yes, financial tool employs industry-standard encryption, multi-factor authentication, and automatic backups to protect your data. They also have permissions for users so that you can restrict who sees certain data.

Is financial tool compatible with other business software?

Yes, financial tool integrates with over three hundred third-party software solutions, including Shopify, PayPal, HubSpot, and TSheets. Integrations enable additional features and business process streamlining.

How much does financial tool cost?

Pricing is determined by the plan and the extras. QuickBooks Online begins with a starter plan for solo professionals and escalates to higher-cost plans for larger businesses. New customers also qualify for promotional discounts.

Can I process payroll in Financial Tool?

Yes, with optional add-on accounting software Payroll, you can track employee wages, benefits, tax payments, and direct deposits inside the software.

Discover more upcoming titles in our Tech Easy Hub.

Explore their services here: Pacerline Outsourcing Services

By leveraging Pacerline’s expertise, you can ensure accurate financial management, allowing you to focus on growing your business.