Jerome Powell the Ship of American Monetary Policy

Introduction: The Man at the Helm

In finance and economics, there are few names as influential and powerful as Jerome Powell. As the Federal Reserve Chair, Powell holds a critical position in determining the economic direction of America and, by implication, the international economy. Sworn in by President Donald Trump in 2018 and subsequently reappointed by President Joe Biden in 2022, Jerome Powell has survived some of the most turbulent financial times of recent history a global pandemic, inflation spikes, and rising geopolitical tensions.

Powell’s choices on interest rates, monetary restraint, and economic stimulus programs influence all the way from suburban America’s mortgage interest rates to investment flows in emerging markets. His deliberate language at press conferences and the Fed’s policy statements often echo through stock exchanges, bond markets, and currency exchange rates around the world.

But who is Jerome Powell, and on what philosophies are his decisions based? What is his history, and how has he shaped the course of the U.S. economy throughout his time in office? This detailed blog delves into Powell’s life, career, Federal Reserve leadership, his reactions to economic downturns, and the legacy he is creating as one of America’s most impactful Fed Chairs ever.

1. Early Life and Education

Jerome Powell was born on February 4, 1953, in Washington, D.C., to a family with long-standing roots of public service. His father was a lawyer, and Powell’s early life was filled with education, integrity, and civic duty. Jerome Powell completed his early education at the esteemed Georgetown Preparatory School and later earned a degree in politics from Princeton University in 1975.

Following Princeton, Powell went on to receive a Juris Doctor degree from Georgetown University Law Center in 1979. During his law studies, Powell’s fascination with economic policy was cemented. His legal career began at Davis Polk & Wardwell but quickly moved into investment banking with Dillon, Read & Co. His dual finance and law background would serve him well at the Federal Reserve later on.

2. Public Service and Joining the Federal Reserve

Jerome Powell served as Under Secretary of the Treasury for Domestic Finance in the early 1990s, under President George H. W. Bush, before becoming a part of the Fed. He served during the crisis involving the savings and loan and gained a strong background in public finance.

Subsequently, Powell moved to the Carlyle Group, a prominent private equity firm, and established a name for himself in financial savviness and risk management. In 2012, President Barack Obama nominated Powell to the Federal Reserve Board of Governors, and he became one of the rare Republicans appointed by a Democratic president to such an important position. The nomination was an acknowledgment of Powell’s bipartisan appeal and pragmatic approach.

3. Becoming Chair of the Federal Reserve

Jerome Powell became Federal Reserve Chairman in 2018, replacing Janet Yellen. Unlike past Fed chairs, Powell is not a Ph.D. economist a circumstance that initially raised some eyebrows. Yet his long government and financial background soon won him acceptance.

Powell’s leadership is practical and open. He eschews too-technical language that Fed communications sometimes use, making monetary policy more public-friendly. Jerome Powell places strong focus on the Federal Reserve’s dual mission: keeping inflation in check while fostering a robust job market.. President Biden’s 2022 reappointment of Powell reaffirmed his cross-party profile and the confidence he had gained in times of economic turmoil.

4. Monetary Policy Under Jerome Powell

Jerome Powell’s monetary policy strategy has changed in accordance with various economic hurdles. During the COVID-19 pandemic, he introduced ultra-low interest rates and quantitative easing to boost the economy. Powell indicated that the Fed would do “whatever it takes” to assist in recovery.

When inflation started to increase in 2021, Powell indicated a pivot. The Fed started tapering purchases of assets and raising interest rates sharply in 2022 to fight inflation. Powell’s evidence-based, flexible strategy allowed the central bank to balance between containing inflation and economic growth a challenging but necessary balance.

5. Managing Economic Emergencies

Crises have defined much of Jerome Powell’s tenure. The COVID-19 pandemic tested central banks worldwide, and Powell responded with swift and comprehensive measures. The Fed launched emergency lending facilities, expanded quantitative easing, and coordinated with international banks to stabilize global markets.

In 2022–2023, Powell faced another crisis: inflation taking off. Disruptions in supply chains, workforce shortages, and sudden spikes in energy costs created significant challenges for the economy. Powell answered with a series of forceful interest rate rises, even at the expense of slowing growth. Controversial as they were, they were intended to reestablish long-term price stability.

6. Acclaim and Criticism

As with any public character at the forefront of economic policy direction, Jerome Powell has received both praise and criticism. The former hails his steady hand amid the COVID-19 pandemic and applauds his flexibility in addressing inflation. His focus on clarity and attempts to de-mystify Federal Reserve policy have also gained traction, particularly among financial markets and economists who prize transparency.

But the critics of Jerome Powell and the Federal Reserve attributed their belated action in the face of inflation. For most of 2021, Powell described inflationary pressures as “transitory,” undermining their endurance. This timidity, some economists further contended, left the Fed with no choice but to raise interest rates aggressively, enhancing the risk of recession.

A second area of contention has been the Fed’s handling of inequality. Although the central bank has few tools with which to address income and wealth disparities, Powell has recognized the worth in employment that is inclusive and opportunity in the economy that is equitable. His focus on full employment has reduced racial and gender disparities in the labor market, but critics call for stronger structural change.

7. Communication Style and Market Influence

Jerome Powell is particularly renowned for his candid style of communication. Unlike some of his predecessors who used to stock their speeches with heavy economic parlance, Powell attempts to simplify the Fed’s moves for the common folk. This has managed to bridge the gap between highly eloquent monetary policies and mundane financial realities.

His news conferences are under close scrutiny by investors, analysts, and policymakers globally. Markets can respond sharply to even a slight change in tone or wording. It is commonly called the “Powell Effect,” referencing the significance of his words in shaping interest rate expectations, inflation expectations, and economic growth expectations.

Besides, Powell has highlighted the use of forward guidance a tool of monetary policy signaling likely future direction of monetary policy. The approach has allowed the Fed to control expectations and prevent market surprises, especially where uncertainty is high.

8. Jerome Powell and Global Economics

Despite Jerome Powell occupying the chair of the U.S. Federal Reserve Chairman, his decisions have far-reaching international implications. As the leader of the world’s most influential central bank, Powell determines global flows of capital, exchange rates, and foreign countries’ monetary policy.

When the Fed does increase interest rates, it will initiate flows of capital out of emerging markets as investors move to obtain higher returns in America. Powell has recognized such spillovers and is still actively engaging in active discussions with their counterparts across the globe through forums such as the G20 and the International Monetary Fund.

During the COVID-19 pandemic, Powell’s coordination with other central banks smoothed world liquidity. The Fed’s swap lines arrangements that loan dollars to foreign central banks were essential in preventing a financial meltdown. Powell’s leadership thus reached far beyond the national horizon and solidified his position as a global economic statesman.

9. Jerome Powell’s Economic Philosophy

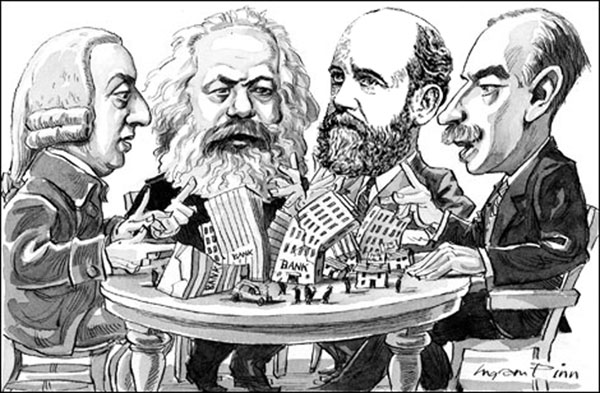

Jerome Powell’s economic philosophy relies on pragmatism and data dependence. Contrary to being ideologically wedded to a given school of economic philosophy, he bases policy choices on what actually occurs in the real world. Such a flexibility has enabled him to respond to changing circumstances and shun ideological stiffness.

Powell has faith in a solid labor market as the key to economic stability. He tends to stress the social dividend of work, including lower poverty and greater opportunity. Beyond that, however, he’s also dedicated to keeping inflation in check, aware that more inflation will mainly hurt lower-income families.

His speech and writings demonstrate a strong appreciation of monetary policy trade-offs. Powell does not like to predict way out, rather making slight adjustments based on where one finds himself at the time. This has been good for the Fed in its efforts to manage turbulent economic conditions.

10. Legacy and Future Prospects

As for Jerome Powell, who finishes his second term as Fed Chair, his legacy is already unfolding. He will be remembered as a crisis manager who rode out unprecedented times — from the pandemic recession to high inflation. His responses in those moments have reshaped the Fed’s role and the limits of monetary policy.

Powell will face new challenges in the future: how to moderate inflation without derailing the growth train, dealing with the risks of an impending financial crisis, and how to take climate and digital money concepts on board in the policy agenda of the Fed. Political pressure, particularly a more polarized Washington, will also push his management to the limit.

Nevertheless, Powell’s calm, bi-partisan support, and commitment to economic stability place him among the most powerful Fed Chairs in history. Only time will say if his policies stand the test of time, but it is guaranteed that Jerome Powell has left a lasting imprint on American and global economics.

11. Technology Innovation and Financial Regulation

Jerome Powell has been keen to know how emerging technologies such as cryptocurrencies, digital assets, and fintech are reconfiguring traditional finance. During his tenure at the helm of the Federal Reserve, the institution has explored central bank digital currencies (CBDCs), in particular, the possibility of a digital dollar.

Powell has been a fiscal conservative but impartial advocate for cryptocurrency. He understands the benefit of financial innovation, yet stressed the necessity of open-ended regulation to safeguard consumers and fiscal solidity. Powell has intimated that any release of a U.S. Any implementation of a U.S. central bank digital currency (CBDC) would require approval from Congress and is intended to complement, not replace, the role of traditional banking institutions.

His perspective shows the changing role of fintech in lending and payment systems as well. Powell supports a regulatory approach that encourages innovation while firmly upholding principles of transparency, equity, and financial safety.

This shows his willingness to surf the wave of change but keeping the safety of the financial system in mind.

12. Diversity, Equity, and Inclusion

Since becoming a member of the Federal Reserve, Jerome Powell has been a vocal champion of the central bank’s attempts to promote more diversity, equity, and inclusion (DEI). As someone who understands that economic inequality is a structural challenge, Powell stressed that a more robust labor market needs to be inclusive on racial, gender, and geographic bases.

During his tenure, the Fed expanded its examination and outreach on racial differences in employment and economic opportunity. He also asked the Reserve Banks to organize public forums and outreach meetings in communities to hear about the experiences of oppressed groups.

Internally, Powell has been a proponent of DEI hiring efforts and worked towards leadership diversification across the Federal Reserve System. Despite hurdles, Powell’s leadership has brought DEI from a moral imperative to a vital economic issue.

13. Climate Change and the Fed

While not historically part of the Fed’s remit, climate change is a risk to the economy. Jerome Powell has reacted by leading the Federal Reserve to consider how climate risks would impact banks and the economy more broadly.

Powell has consistently argued that the Fed is not an environmental policymaker but rather a financial stability regulator. During his tenure, the Fed became a member of the Network for Greening the Financial System (NGFS) and launched climate scenario analysis to help evaluate long-term financial risks.

He navigates finely between advocating greater risk management in banks and ensuring the Fed’s political autonomy. His conservatism attempts to keep the Fed on task while yielding to 21st-century economic risk evolution.

14. Congressional Relations and Political Neutrality

Jerome Powell’s strongest asset is that he is apolitical. Although he was appointed by President Trump and reappointed by President Biden, Powell has prioritized keeping the Federal Reserve free of partisan politics.

His frequent testifying before Congress demonstrates him to be accessible, yet also sets the Fed’s apolitical mission. Powell’s even-keel manner and measured responses have gained both sides’ respect, even during heated debates over economic issues.

Even in the presence of personal criticism or political pressure like Trump’s calls for lower rates Powell stuck to his guns. He is devoted to the Fed’s dual mandate and has proved that monetary policy must be guided by economic considerations, not by political expediency

15. Public Perception and Impact on Future Leaders

Jerome Powell is now one of the most respected names in economics. His handling of the crisis, transparent communication, and practical approach to working have gained him universal respect from economists, investors, and the common population alike.

Powell has always had better ratings in polls than other political leaders. This is largely because he is a non-partisan figure and can simplify complex problems into easy-to-understand language that anyone can listen to.

Powell’s leadership will shape central bankers in the future. His transparency, his commitment to diversity, and his adaptability provide a template for central banking through uncertain times. Through his approach to inflation, digital transformation, and economic inequality, Jerome Powell has demonstrated how thoughtful and balanced leadership can guide monetary policy through turbulent times.