Personal Finance Apps: The Complete Guide in 2025

The Complete Guide to Personal Finance Apps in 2025: Get Your Money in Order

Introduction

With an age where it seems like everything around us is going digital, money management hasn’t been left behind. We have moved away from paper spreadsheets and ledgers to mobile apps that give you instant scores on the state of your finances. The personal finance apps have become life-changing tools for those seeking financial well-being. With digital banking, contactless payments, and robo-advisors leading the way, money management is now more convenient than ever.

Personal finance applications aren’t strictly for keeping up with expenses—there are literally dozens of options to aid in budgeting, saving, investing, bill payments, and sure, even retirement planning. Regardless of whether you’re a first-timer new to the process of budgeting or an experienced veteran dealing with multiple streams of income, there’s a financial application on the market available for you. In this comprehensive guide, we will discuss all you need to know about personal finance apps, including their features and advantages and the best ones available in 2025.

What is a Personal Finance App?

A personal finance app is a computer program—usually on smartphones, tablets, and computers—that helps people organize various aspects of their money life. The apps connect with bank accounts, credit cards, investment sites, and so on to provide an overview of your money. Common features include tracking expenses, budgeting, tracking investments, debt tracking, and saving goals.

Types of Personal Finance Apps:

Budgeting Apps: Emphasize assisting the user in setting up and maintaining a budget. YNAB (You Need A Budget) and Good budget are great options.

Expense Trackers: Assist the user in tracking and labeling daily expenditures, such as Spendee or Expense IQ.

Investment Trackers: Used for monitoring portfolios, such as Empower and Personal Capital.

Bill Management: Stay Ahead of Due Dates and Avoid Late Fees. Prism is an excellent option.

Savings and Goal-Based Apps: Assist people in setting and reaching certain savings targets. Some examples of these are Qapital and Digit.

Advantages of Personal Finance Apps

- Real-Time Monitoring: Most apps connect directly to your bank and card accounts, showing you your balance and transactions in real time.

- Automated Budgeting: Depending on your income and spending patterns, apps can set an automatic budget for you and dynamically adjust it.

- Financial Goal Setting: From saving for a vacation to debt repayment, you can set goals and track your progress.

- Bill Management: Receive reminders of outstanding bills to avoid late fees and payment charges.

- Better Financial Literacy: Discover how to budget, invest, and manage debt through in-app tutorials and educational material.

- Security Features: Strong encryption, biometric log-ins, and multi-factor authentication protect your data.

Key Features to Consider When Choosing a Personal Finance App

- Bank Integration: Real-time bank integration to save time and avoid mistakes.

- Expense Categorization: Systematic labeling of expenses so you can see spending habits.

- Custom Budgets: Option to allocate particular budgets to various categories.

- Alerts and Notifications: Informative notifications for bills, low account balances, or excessive spending.

- Reports and Analytics: Visualized breakdowns and analysis of where your money is spent.

- Multi-Device Access: Sync between mobile and desktop platforms.

- Customer Support: Having support through chat, email, or phone is most important for troubleshooting.

Top 10 Personal Finance Apps in 2025

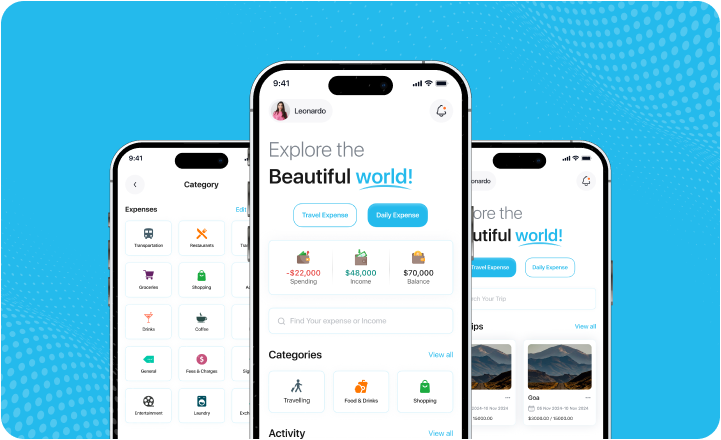

1. Mint

Overview: Timeless alternative for expense tracking and budgeting.

Features: Bank syncing, bill tracking, credit score tracking.

Pros: Free, simple, broad integration.

Cons: Aggressive ads, poor investing functionality.

2. YNAB (You Need A Budget)

Overview: Focuses on forward-looking budgeting.

Features: Zero-based budgeting, goal tracking, reporting.

Pros: Great for budgeting enthusiasts.

Cons: A steep learning curve and requires a paid subscription.

3. Pocket Guard

Overview: Shields users against overspending.

Features: “In My Pocket” summaries, tracking of expenses.

Pros: Clean, simple interface.

Cons: Limited customization.

4. Goodbudget

Overview: Envelope budgeting system.

Features: Manual entry, sync across devices.

Pros: Great for couples.

Cons: Manually time-consuming tracking.

5. Monarch Money

Overview: Full financial control.

Features: Budgeting, investments, goal setting.

Pros: Good design, dashboards.

Cons: Premium price.

6. Empower (formerly Personal Capital)

Overview: Brings budgeting and wealth management together.

Features: Investment tracking, asset allocation, goal setting.

Pros: Comprehensive tool.

Cons: Limited desktop use.

7. Zeta

Overview: Good for couples.

Features: Shared finances, paying bills.

Pros: Fantastic for shared budgeting.

Cons: Few users.

8. Spendee

Overview: Easy, colorful interface.

Features: Tracking of spending, shared wallets.

Pros: Fantastic graphics.

Cons: Limited free version.

9. Toshl Finance

Overview: Humorous, entertaining interface.

Features: Currencies supported, budgeting.

Pros: Excellent for foreign users.

Cons: Take time to get used to.

10. Money Lover

Overview: Used heavily in Asia.

Features: Debt tracking, saving goals.

Pros: Localized features.

Cons: Advertisements in free version.

How to Select the Perfect Finance App for You

Define Your Purpose: Budgeting, savings, investments, debt management?

Evaluate your spending habits: Do you need to monitor your expenses every day, or is a monthly overview sufficient for your needs?

Verify Platform Support: Make sure it is supported on iOS, Android, or desktop.

Compare the Pricing Models: Free versus paid features.

Read Reviews: Check out ratings and reviews from others.

Try User Experience: Does the design suit you?

Consider Customer Support: Particularly for paid apps.

How Personal Finance Apps Assist with Budgeting

Personalized Budgets: Organize by your lifestyle.

Income Planning: Align spending with your pay cycle.

Spending Analysis: Charts that indicate where your money is being spent.

Budget Adjustments: Dynamic adjustments when habits change.

Alerts: Overspending or running low notifications.

Historical Comparisons: Take a look at past habits.

Unifying Investment & Debt Management in One

Investment Tracking: Monitor stocks, crypto, mutual funds.

Net Worth Overview: Assets – liabilities.

Debt Payment Plans: Loan and credit card debt payment plans.

Automatic Contributions: Invest and save automatically.

Risk Analysis: View investments compared to goals.

Security & Privacy in Finance Apps

Encryption of Data: Your financial information is safe.

Two-Factor Authentication: Provides a second line of security.

Biometric Access: Face or fingerprint unlock.

No Selling of Data Policies: Select apps that do not sell your data.

Trusted Providers: Select apps from reputable providers.

Personal Finance Advice for App Users

Set Realistic Goals: Don’t complicate your budget.

Review Weekly: Spend 10 minutes weekly reviewing your progress.

Use Categories Wisely: Keep them straightforward and applicable.

Automate Savings: Automate transfers.

Track Everything: Little things count.

Avoid App Hopping: Stay consistent with a single app.

Future of Personal Finance Apps

AI Integration: Predictive spend alerts, intelligent categorization.

Voice Assistant Compatibility: Control finances with Alexa or Google Assistant.

Open Banking: Simpler and wider account linkages.

Gamification: Make saving a game.

Decentralized Finance (DeFi): Savings and investment services that are blockchain-based.

Conclusion

Apps for personal finance have revolutionized the way individuals manage money. They provide transparency, control, and ease when it comes to making everyday money decisions. Whether you want to budget, save for a holiday, or invest, there is an app designed for your needs.

As we continue to progress in the digital era, the use of finance apps will only grow stronger in our everyday lives. Tap into the technology now and begin your path towards becoming financially empowered. By selecting the proper app and utilizing it on a regular basis, you will develop improved habits, make wiser choices, and ultimately reach your financial objectives.

For more tips on managing your money smartly, explore our SpendSmart articles to deepen your financial knowledge. And if you’re looking for tools that align with your fitness and financial goals, check out Pacerline, a unique platform that rewards healthy habits.

1 thought on “Personal Finance Apps: The Complete Guide in 2025”